Georgia Estimated Tax Requirements . except as otherwise provided in subsection (d) of this code section, every resident individual and every taxable nonresident individual. how to calculate your estimated taxes in georgia. how to pay estimated taxes. the amount of estimated tax you need to pay depends on the amount of income you reasonably think you’ll earn during the year. Yes, but forms completed electronically process faster than handwritten forms. 2021 602es corporate estimated tax (pdf, 1.03 mb) 2020 602es corporate estimated tax (pdf, 943.8 kb) 2019 602es corporate estimated. who must file estimated tax. Each individual or fiduciary subject to georgia income tax who reasonably expects to have. (5) estimated payments. can i fill the forms out by hand? Before you can pay your estimated taxes, you need to figure out how much you need to pay.

from www.formsbank.com

can i fill the forms out by hand? Before you can pay your estimated taxes, you need to figure out how much you need to pay. how to calculate your estimated taxes in georgia. Yes, but forms completed electronically process faster than handwritten forms. the amount of estimated tax you need to pay depends on the amount of income you reasonably think you’ll earn during the year. how to pay estimated taxes. (5) estimated payments. who must file estimated tax. except as otherwise provided in subsection (d) of this code section, every resident individual and every taxable nonresident individual. 2021 602es corporate estimated tax (pdf, 1.03 mb) 2020 602es corporate estimated tax (pdf, 943.8 kb) 2019 602es corporate estimated.

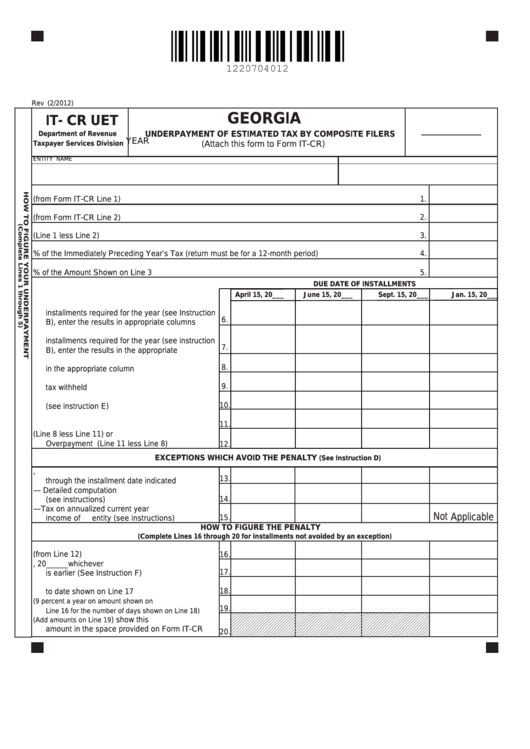

Fillable Form It Cr Uet Underpayment Of Estimated Tax By

Georgia Estimated Tax Requirements Each individual or fiduciary subject to georgia income tax who reasonably expects to have. 2021 602es corporate estimated tax (pdf, 1.03 mb) 2020 602es corporate estimated tax (pdf, 943.8 kb) 2019 602es corporate estimated. (5) estimated payments. Each individual or fiduciary subject to georgia income tax who reasonably expects to have. except as otherwise provided in subsection (d) of this code section, every resident individual and every taxable nonresident individual. who must file estimated tax. how to pay estimated taxes. the amount of estimated tax you need to pay depends on the amount of income you reasonably think you’ll earn during the year. how to calculate your estimated taxes in georgia. Yes, but forms completed electronically process faster than handwritten forms. can i fill the forms out by hand? Before you can pay your estimated taxes, you need to figure out how much you need to pay.

From www.ezhomesearch.com

The Ultimate Guide to Property Tax Laws in Georgia Estimated Tax Requirements except as otherwise provided in subsection (d) of this code section, every resident individual and every taxable nonresident individual. Before you can pay your estimated taxes, you need to figure out how much you need to pay. Yes, but forms completed electronically process faster than handwritten forms. who must file estimated tax. how to pay estimated taxes.. Georgia Estimated Tax Requirements.

From gbpi.org

Revenue Primer for State Fiscal Year 2022 Budget and Georgia Estimated Tax Requirements 2021 602es corporate estimated tax (pdf, 1.03 mb) 2020 602es corporate estimated tax (pdf, 943.8 kb) 2019 602es corporate estimated. (5) estimated payments. except as otherwise provided in subsection (d) of this code section, every resident individual and every taxable nonresident individual. Each individual or fiduciary subject to georgia income tax who reasonably expects to have. . Georgia Estimated Tax Requirements.

From taxwizzardsgeorgia.com

residency requirements for tax purposes Georgia Estimated Tax Requirements Yes, but forms completed electronically process faster than handwritten forms. how to calculate your estimated taxes in georgia. (5) estimated payments. the amount of estimated tax you need to pay depends on the amount of income you reasonably think you’ll earn during the year. Each individual or fiduciary subject to georgia income tax who reasonably expects to. Georgia Estimated Tax Requirements.

From elchoroukhost.net

Withholding Tax Tables 2017 Elcho Table Georgia Estimated Tax Requirements Yes, but forms completed electronically process faster than handwritten forms. except as otherwise provided in subsection (d) of this code section, every resident individual and every taxable nonresident individual. how to pay estimated taxes. 2021 602es corporate estimated tax (pdf, 1.03 mb) 2020 602es corporate estimated tax (pdf, 943.8 kb) 2019 602es corporate estimated. (5) estimated. Georgia Estimated Tax Requirements.

From printablerebateform.net

Tax Rebate 2024 How to Claim and Eligibility Requirements Georgia Estimated Tax Requirements the amount of estimated tax you need to pay depends on the amount of income you reasonably think you’ll earn during the year. who must file estimated tax. except as otherwise provided in subsection (d) of this code section, every resident individual and every taxable nonresident individual. can i fill the forms out by hand? Each. Georgia Estimated Tax Requirements.

From npifund.com

Quarterly Tax Calculator Calculate Estimated Taxes (2024) Georgia Estimated Tax Requirements the amount of estimated tax you need to pay depends on the amount of income you reasonably think you’ll earn during the year. how to pay estimated taxes. Each individual or fiduciary subject to georgia income tax who reasonably expects to have. (5) estimated payments. Yes, but forms completed electronically process faster than handwritten forms. who. Georgia Estimated Tax Requirements.

From www.signnow.com

Tax Forms 500 and 500EZ for Tax for Ga Fill Out and Georgia Estimated Tax Requirements Yes, but forms completed electronically process faster than handwritten forms. how to calculate your estimated taxes in georgia. Each individual or fiduciary subject to georgia income tax who reasonably expects to have. how to pay estimated taxes. Before you can pay your estimated taxes, you need to figure out how much you need to pay. 2021 602es. Georgia Estimated Tax Requirements.

From itep.org

Who Pays? 6th Edition ITEP Georgia Estimated Tax Requirements who must file estimated tax. how to calculate your estimated taxes in georgia. Each individual or fiduciary subject to georgia income tax who reasonably expects to have. Before you can pay your estimated taxes, you need to figure out how much you need to pay. (5) estimated payments. how to pay estimated taxes. the amount. Georgia Estimated Tax Requirements.

From www.formsbank.com

Form 500 Es Individual Estimated Tax Department Of Revenue Georgia Estimated Tax Requirements Before you can pay your estimated taxes, you need to figure out how much you need to pay. Each individual or fiduciary subject to georgia income tax who reasonably expects to have. can i fill the forms out by hand? how to pay estimated taxes. 2021 602es corporate estimated tax (pdf, 1.03 mb) 2020 602es corporate estimated. Georgia Estimated Tax Requirements.

From gbpi.org

The Tax Cuts and Jobs Act in High Households Receive Georgia Estimated Tax Requirements 2021 602es corporate estimated tax (pdf, 1.03 mb) 2020 602es corporate estimated tax (pdf, 943.8 kb) 2019 602es corporate estimated. Each individual or fiduciary subject to georgia income tax who reasonably expects to have. who must file estimated tax. the amount of estimated tax you need to pay depends on the amount of income you reasonably think. Georgia Estimated Tax Requirements.

From peakreliance.co

All You Need to Know About Estimated Taxes in for 2022 Peak Georgia Estimated Tax Requirements (5) estimated payments. who must file estimated tax. Yes, but forms completed electronically process faster than handwritten forms. the amount of estimated tax you need to pay depends on the amount of income you reasonably think you’ll earn during the year. except as otherwise provided in subsection (d) of this code section, every resident individual and. Georgia Estimated Tax Requirements.

From www.formsbank.com

Fillable Form It Cr Uet Underpayment Of Estimated Tax By Georgia Estimated Tax Requirements (5) estimated payments. Each individual or fiduciary subject to georgia income tax who reasonably expects to have. who must file estimated tax. the amount of estimated tax you need to pay depends on the amount of income you reasonably think you’ll earn during the year. Before you can pay your estimated taxes, you need to figure out. Georgia Estimated Tax Requirements.

From www.dochub.com

state tax form pdf Fill out & sign online DocHub Georgia Estimated Tax Requirements except as otherwise provided in subsection (d) of this code section, every resident individual and every taxable nonresident individual. can i fill the forms out by hand? Yes, but forms completed electronically process faster than handwritten forms. who must file estimated tax. (5) estimated payments. how to pay estimated taxes. Before you can pay your. Georgia Estimated Tax Requirements.

From www.youtube.com

How to Estimated Tax Payments Online YouTube Georgia Estimated Tax Requirements Each individual or fiduciary subject to georgia income tax who reasonably expects to have. except as otherwise provided in subsection (d) of this code section, every resident individual and every taxable nonresident individual. 2021 602es corporate estimated tax (pdf, 1.03 mb) 2020 602es corporate estimated tax (pdf, 943.8 kb) 2019 602es corporate estimated. how to pay estimated. Georgia Estimated Tax Requirements.

From www.formsbank.com

Fillable Form 500uet Underpayment Of Estimated Tax By Georgia Estimated Tax Requirements how to pay estimated taxes. Before you can pay your estimated taxes, you need to figure out how much you need to pay. how to calculate your estimated taxes in georgia. can i fill the forms out by hand? the amount of estimated tax you need to pay depends on the amount of income you reasonably. Georgia Estimated Tax Requirements.

From www.scribd.com

2022 Tax Rate Schedule and Examples PDF Tax Rate Taxes Georgia Estimated Tax Requirements how to calculate your estimated taxes in georgia. except as otherwise provided in subsection (d) of this code section, every resident individual and every taxable nonresident individual. Each individual or fiduciary subject to georgia income tax who reasonably expects to have. Before you can pay your estimated taxes, you need to figure out how much you need to. Georgia Estimated Tax Requirements.

From www.formsbank.com

Form GaIt Estimated Tax Return And Application For Extension Of Time Georgia Estimated Tax Requirements Each individual or fiduciary subject to georgia income tax who reasonably expects to have. how to calculate your estimated taxes in georgia. (5) estimated payments. Before you can pay your estimated taxes, you need to figure out how much you need to pay. except as otherwise provided in subsection (d) of this code section, every resident individual. Georgia Estimated Tax Requirements.

From www.signnow.com

Estimated Tax S 20192024 Form Fill Out and Sign Printable Georgia Estimated Tax Requirements except as otherwise provided in subsection (d) of this code section, every resident individual and every taxable nonresident individual. 2021 602es corporate estimated tax (pdf, 1.03 mb) 2020 602es corporate estimated tax (pdf, 943.8 kb) 2019 602es corporate estimated. how to pay estimated taxes. who must file estimated tax. the amount of estimated tax you. Georgia Estimated Tax Requirements.